There are some deductions still available under the AMT:

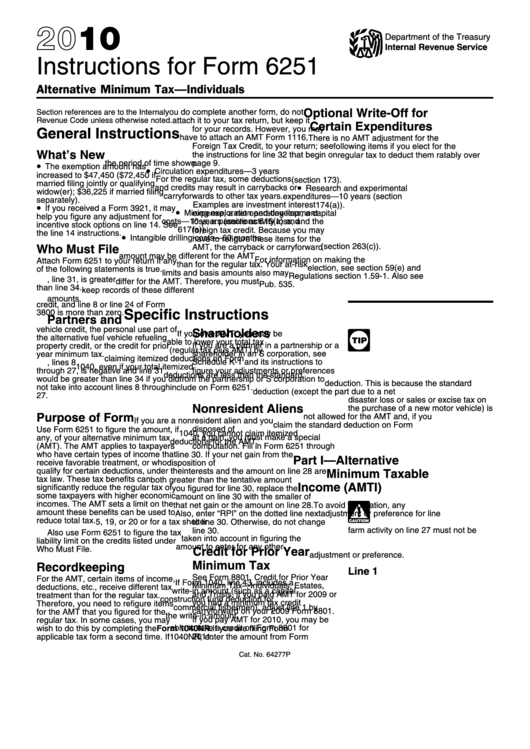

After calculating the tax liability under the regular tax system and under the AMT system, the taxpayer pays the greater amount.Īccording to the Urban-Brookings Tax Policy Center, the Tax Cuts and Jobs Act greatly reduced the number of taxpayers liable for the AMT, from about 5.1 million taxpayers in 2017 to about 200,000 taxpayers in 2020. There are also restrictions on claiming itemized deductions, accelerated depreciation, and certain other specialized deductions and credits. The AMT is calculated based on the alternative minimum taxable income ( AMTI) that includes all income taxable under the regular tax system plus some income tax exempt under the regular tax system. To prevent that, the tax law provides for an alternative minimum tax ( AMT) system, first implemented in 1969, that is parallel to the regular tax system.

Indeed, during the 1970s and the 1980s, many wealthy people paid no income tax whatsoever. However, most of these also benefited the wealthy. Many tax deductions were intended for the middle class so that they can afford a minimum living. Alternative Minimum Tax (AMT) for Individuals › Money › Taxes › Income Taxes Alternative Minimum Tax (AMT) for Individuals

0 kommentar(er)

0 kommentar(er)